Key Points

- NEC4 ECC and PSC Option C and E contracts allow the project or service manager to check the contractor’s or consultant’s records that ultimately support defined cost payments.

- The cost of labour and agency staff working on the contract should be included in the defined cost for people and set out in the schedule of cost components.

- This article provides guidance on what to look for when auditing labour and agency costs on NEC4 Option C and E Contracts.

NEC4 Engineering and Construction Contract (ECC) Option C (target contract with activity schedule) and E (cost reimbursable contract) are commonly used for procuring high-risk infrastructure projects in the UK. The basic clauses allow project managers to inspect accounts and records of their choice in relation to defined cost items claimed.

In issue 129 I provided guidance on the audit of directly employed staff costs (Ward, 2024). These typically form a significant portion of people costs on any given project, although there is no formal separation as such into staff and labour costs (beneath people) in the contract. Two other types of people cost may also need careful review: directly employed operatives and other people not employed by the contractor. These are usually white-collar agency staff or blue-collar labour-only subcontractors.

The cost of directly employed operatives will be audited against a list of allowable items under the schedule of cost components. Defined cost claimed is mostly hours worked multiplied by a pay rate as most operatives are reimbursed against a structured pay card, incorporating different hourly rates for varying work patterns. These pay cards are often linked to the various working rule agreements specific to trade disciplines, which sometimes get enhanced on major projects.

Beyond the calculated hours-based pay, there will often be add-ons for travel costs and the usual payroll related items: employer’s national insurance, pension contributions and holiday pay. Assurance work on the cost side will be focused around payslips, employment contracts and payroll reports. Operatives tend to get paid weekly or fortnightly in most organisations.

Time demonstration may be linked back to a range of records, including timesheets (as a minimum), plus signing in and out sheets, site diaries, allocation sheets and swipe or attendance records.

Many contractors do not directly employ operatives but outsource blue-collar workers to labour-only subcontractors. Therefore, costs for these people are typically based on invoices paid by the contractor and are not cost components under schedule of cost components items 11–13. When blue-collar workers are sourced via a labour-only subcontractor, they tend to work under the day-to-day instruction of the contractor, and therefore are not categorised under NEC4 as subcontractors.

NEC4 auditors should expect to review defined costs from formal and well-established agencies down to sole traders. This guidance note will focus on the audit of blue-collar and labour-only subcontractors. For white-collar agency staff, the guidance given in the previous article should be referred to.

Read the contract

When it comes to planning assurance work, the first step (as always) is to read the contract carefully and its rules to understand the cost management environment under which costs may be claimed. For directly employed labour, auditors should review the detailed scope information and Z Clauses for any rule changes, and check the reimbursement method. Occasionally, defined cost is based on pre-agreed rates and not under schedule of cost components items 11–13.

Auditors should check for any mobilisation and induction rules, such as the client validating Construction Skills Certification Scheme competence cards, and there may be obligations for the contractor to use local labour or employ apprentices. Auditors should also consider the following questions:

- How detailed are the rules in the contract around time charging? Is it absolutely clear on travel, wash up and break times? This is key if hours are to be compared to swipe data.

- Must a timesheet specify certain information or narrative in an agreed format?

- Who (client and supplier side) must approve the hours, and by when? Are hours capped or adjusted on timesheets?

- Are there any rules regarding pre-authorisation of overtime, shift patterns or ad hoc off-site meetings?

- How do timesheet hours cross reference to allocation sheets or site diaries for formal works completion?

For labour-only subcontractors, the cost of this labour is recovered under the schedule of costs components item 14. There are rarely additions to the main contract rules specific to labour-only subcontractors. However, there will be charging rules between the contractor and the labour-only subcontractor which need to be reviewed. This may be a call-off from a framework type agreement, or project specific.

Auditors should check whether blue-collar operatives are being charged at the correct rates in the labour-only subcontract. In addition, they should verify the right skill has been demonstrated to validate that rate. For example, the labour only subcontract may specify checking competency records or formal qualifications to justify the worker is charged at the correct rate.

On high-spend labour-only subcontracts, further rules may have to be audited, relating to compliance with modern slavery and industrial relations practices. Volume rebates can also be present on such contracts.

Understand the environment

Whether reviewing the cost of directly employed labour or labour-only subcontractors, a good understanding of the project environment and how the costs are prepared, controlled and reported is key. This heavily influences the risk of defined cost error. Auditors should consider key processes and controls to ensure accurate charging: who can join or charge to a project and how are timesheets captured, checked and authorised? Is travel time charged? Can timesheets be amended retrospectively?

Auditors should speak with the contractor’s labour manager to confirm how labour is controlled day to day. They should physically observe daily sign in and out processes and timesheet compilation, and ask basic questions about what the labour force does, where and when, how they get to site (sometimes via bussing on larger programmes), shift and break patterns, toolbox talks, wash-up time and so on. They should also ask what other cost elements should be aligned, such as daily van movements.

It is also important to understand the physical site. Regular visits to the site are key to understanding the risks, such as the nature and complexity of the work, and how close the work faces are to the employer or project teams. If close, this should give extra comfort on head count charging and working patterns.

Auditors should also determine how the labour account has progressed to date. Is there a good narrative on cumulative labour costs, head-count or full-time equivalents and progress against the programme? Have any costs been disallowed or withheld and have these been challenged? Finally, auditors need to keep track of where their audit is going: is it basic support for the project manager in application assessments or is it something wider, such as clause 50.9 or final account implications?

Visualise data and design tests

People data for directly employed labour and labour-only subcontractors is often shared by contractors more quickly, and in greater detail, than staff data. This is because there is a lower data protection risk as labour pay is often uniform and tied to publicly available information. Still, auditors should be aware of their data protection responsibilities as data processors.

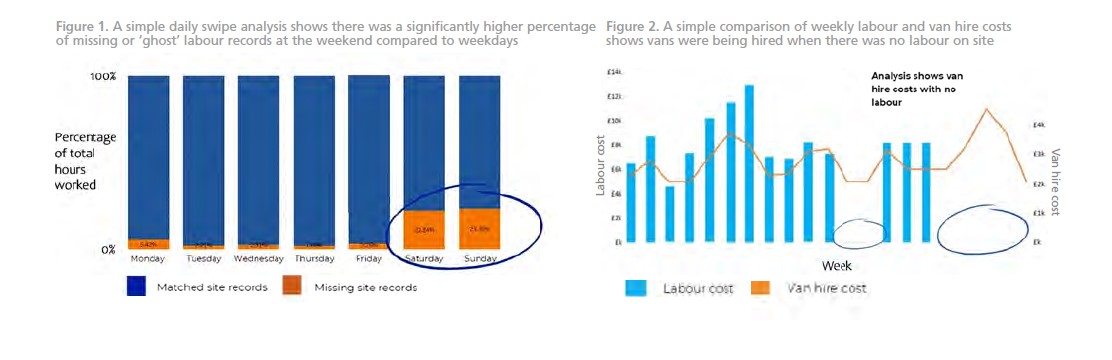

With a decent data set, much analysis is possible across data fields such as name, trade, rate, hours, date and work description. With swipe data added, the scope is almost endless. However, auditors need to be pragmatic and not over analyse: they need to keep it relevant to contract rules. Two powerful yet simple pieces of visual analysis are shown in Figures 1 and 2.

Once auditors have a thorough understanding of the site environment, plus a good data analysis, they can identify the biggest mis-charging risks against the identified rules. They should then design tests for the risks for directly employed labour or labour-only subcontractor costs.

Underlying application structures and supporting accounting records always differ and the testing approach should reflect this. For example, auditors should not test 100% of timesheets simply because they did it on their last project: assurance work needs to be smart.

Evaluate records and report findings

After designing the tests, auditors need to work up an effective sampling strategy for risk-based and other core transactions giving the assurance coverage required.

They should challenge the findings of large overcharges so they do not fall away under review. For each significant finding ask: what is the root cause – a control problem or an isolated error? Does the contractor’s response hang together? Should the sampling be widened or the results extrapolated to better understand the problem? Is the calculation and approach clear?

Finally, auditors should always write up and report their findings, and store them securely.

References

Ward D (2024) Assuring staff costs on NEC4 Option C and E Contracts. NEC Newsletter 129 (January 2024): 9–10.